The situation regarding the pandemic of COVID-19 has not improved with the arrival of the new year. The Czech Ministry of Industry and Trade introduced a new program COVID – Gastro compensating entrepreneurs who were obliged to close or otherwise have restricted their establishments due to valid measures of the Czech Government or the Czech Ministry of Health.

In general

The new COVID – Gastro program prepared by the Ministry of Industry and Trade was approved by the Czech Government on 4 January 2021. COVID – Gastro works on the principle of a compensatory tool for entrepreneurs whose business activities have been restricted by government crisis measures. The state will contribute to the affected entrepreneurs for the costs of operating and maintaining business activities, such as personnel costs, material costs, loan repayments, depreciation, taxes, etc.

The relevant period from 14 October to 10 January 2021 will be taken into account for the application for compensation under the 1st call.

The rules of the program

Entrepreneurs, natural or legal persons who carry out business activities based on the Trade Licensing Act will be able to apply for compensation. Furthermore, the applicant entrepreneur had to reduce the operation of his business activities in direct connection with the adoption of crisis measures by the government from 14 October 2020, and at the same time employed or worked with self-employed persons. The conditions for drawing compensation must be met cumulatively.

Amount of compensation

The amount of compensation for each employee will reach up to CZK 400 per day for which the business activity of the operator was limited based on government measures.

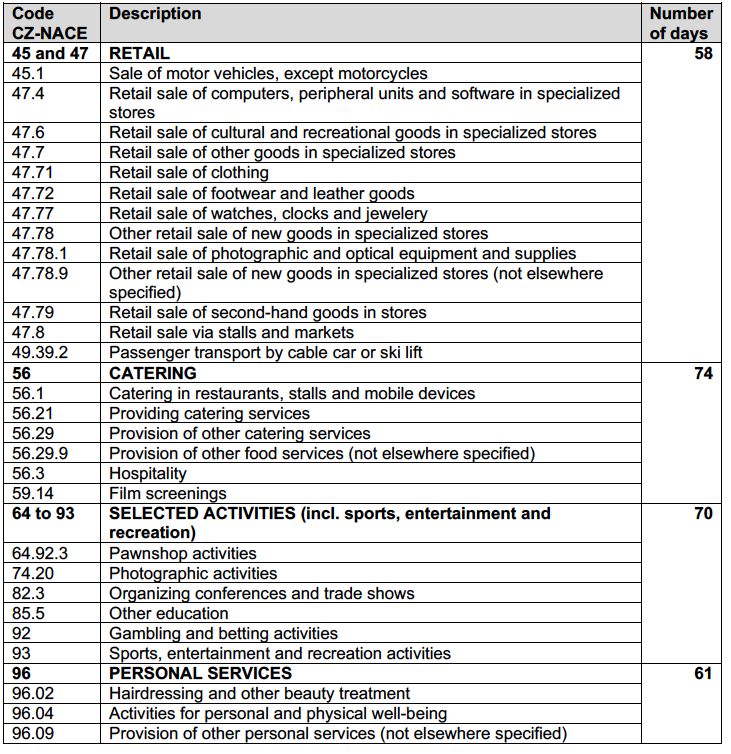

The calculation of the compensation depends on the number of days between 14 October 2020 and 10 January 2021, when the restrictions imposed by the government’s crisis measures are applied to the given sector.

In the case of part-time employees, the entrepreneur requesting compensation will calculate the relevant coefficient as a full-time conversion.

An overview of the sectors and the number of recognized days for determining the amount of support is set out in Annex 2 to the program.

The final list of eligible sectors will be specified in the call issued by the Ministry of Industry and Trade for support under the program.

In order for compensation to be provided, additional conditions of the program must be met, i.e. for the provision, employees for whom the insurance premium was paid in October 2020 to the account of the relevant social security administration are counted for the provision.

The financial compensation resulting from the new program is limited by the exhaustion of the limit according to point 3.1 of the Temporary Framework of the European Commission, the amount of support per one beneficiary (enterprise) is, therefore, a maximum of 800,000 EUR, which will mean that larger retail or chain entrepreneurs in particular will no longer be able to use this support, as support under the COVID program – Rent or Antivirus A Plus is already included in this limit.

Application for compensation

It will be possible to submit applications electronically from 15 January 2020 via the Agenda Information System of the Ministry of Industry and Trade.

Entry (applicant registration, login) into the AIS MIT subsidy information system is enabled exclusively through a means of electronic identification (eIdentita portal). To obtain an identity on the eIdentita portal, a natural person can use an e-Citizen, NIA ID (formerly a User Account of the eidentita.cz portal), a Starcos chip card, or mojeID. It is also possible to verify the identity using a combination of “Name, password, SMS”.

The application for compensation includes a solemn declaration of the applicant containing, in particular, confirmation that:

- all information provided in the application for support is complete and true;

- is an eligible applicant according to Article 4 of the program;

- on the date of submission of the application, and for the entire period for which it applies for support, was a business entity authorized to carry out the declared business activity;

- has not interrupted the operation of a trade, or the operation of trade has not been suspended or it has not interrupted the operation of business activity based on a legal regulation other than the Trade Licensing Act;

- is a tax subject according to Act 280/2009 Coll., the Tax Code;

- the court for his property under Act No. 328/1991 Coll., on Bankruptcy and Settlement, did not declare bankruptcy, did not allow settlement, or did not reject the proposal to declare bankruptcy due to lack of assets;

- under the provisions of Section 136 of Act No. 182/2006 Coll., on Bankruptcy and Ways of Resolving It (Insolvency Act), no decision was made on its bankruptcy;

- the court or administrative body has not issued an order ordering the enforcement of the decision on his property or has not ordered the execution of his property;

- is not in liquidation;

- the company or business activity does not meet the conditions of the Insolvency Act for the commencement of collective insolvency proceedings, except those companies or business activities that meet the conditions for the commencement of collective insolvency proceedings due to the spread of COVID-19 caused by SARS-CoV-19;

- notes the processing of personal data for the administration of the program;

- in the case of the provision of support in the required amount, the beneficiary will not exceed the support limit according to point 3.1 of the Temporary Framework of the European Commission;

- waives further compensation from the state in connection with the restriction of business based on crisis measures of the government for the period for which it requests the provision of support from the program;

- does not terminate its activities within at least three months of receiving the aid.

Conclusion

We recommend you follow the website of the Ministry of Industry and Trade of the Czech Republic for current information. More information about the COVID – Gastro program can be found on the MIT website: https://www.mpo.cz/cz/rozcestnik/informace-o-koronavirus/program-covid-_-gastro-_-uzavrene-provozovny–258742/.

In case of any questions or in case of support with the preparation of an application for support from the COVID – Gastro program, we are at your disposal – do not hesitate to contact us.

Mgr. Jakub Málek, partner – malek@plegal.cz

Eliška Vetýšková, legal assistant – vetyskova@plegal.cz

14. 01. 2021